Our Media

With the Years of Experience, Kulu has formed great lucrative relationships that also serves a support base for the continous success of this business

Kulu Group Holdings- believes in investing in people as its “most valuable asset”

Emphasizing its staff, comprising more than 500 permanent employees, as its “most valuable asset, “Kulu Group Holdings Chairman Musa Mazubane, states that, “we run the company holistically, therefore, there is no wastage of resources. I think we have the best employees.”

Group Chief Executive, Gugu Hlongwane says as a result of Musa Mazubane’s philosophy, which emphasises discipline, Kulu Group Holdings employees take pride in their work and look after the company’s assets. “In this business, there is opportunity for wastage, steeling and the abuse of equipment.”

Further, Kulu Group Holdings also believes in investing in the improvement of the livelihoods of the people surrounding its projects.

“We are a big company, but we do not operate in isolation. Almost 80% of the people – the core labourers involved in our projects – come from the communities surrounding our projects. We train them to effectively operate our equipment and how to do the work that is required.”

In terms of corporate social investment, Hlongwane says Kulu Group Holdings has spent more than R5-million on initiatives linked to its projects across SA.

The company’s initiatives include renovating schools for the disabled and improving its sports grounds, clinics, as well as upgrading sports clubs, and local schools to ensure that learners are taught in a conducive environment as part of its efforts to plough funds back into the communities where it is active.

- All

- Shanduka Events

- CSI Projects

- Media coverage

- Mining Indaba

- Kulu News

- Others

South African miners swing to R17bn profit

Sanral releases draft empowerment policy

A new Branch is opened in Botswana

Kulu Group Holdings interacted with Murray Roberts during Mining Indaba 2017'

Kulu Group Holdings during 'Investing in African Mining Indaba 2017'

Kulu Group Holdings during 'Investing in African Mining Indaba 2017'

Kulu Group Holdings at the Mining sector 'Mining Indaba 2017'

Opportunities in the Mining sector 'Mining Indaba 2017'

Kulu Group Holdings Directors 'Investing in African Mining Indaba 2017'

Kulu Group Holdings to attend the 'Investing in African Mining Indaba 2017'

Kulu Group Holdings won an award of The Best Perfoming Company

Kulu Group Holdings won an award of Most Job created

Kulu Group Holdings won an award of Most Job created

At uKhozi FM ezanamuhla, phecelezi Current Affairs

2017 looks to be an equally good year for us in the mining sector

Kulu Group Holdings won an award of Most Job created

Kulu Group Holdings had a successful Team Building

Kulu Group Holdings has employed 12 Civil Engineering students

Kulu Group Holdings Awarded Tender to the value of R91 million

CEO of Kulu Mining & Executive Chairman-Debeers

Mxolisi Mgojo-CEO Exxaro

Networking Sessions

CEO of Kulu Mining

Kulu Group Holdings Group won an award of Most Job created

Kulu Group Holdings Directors with the Mayor of Congo

Construction industry in rapid decline as work wanes, ‘mafia’ takes over, warns Safcec

The South African construction industry is in a state of accelerated decline, says South African Forum of Civil Engineering Contractors (Safcec) CEO Webster Mfebe.

This is caused mainly by a lack of new contracts flowing from government’s purse, as well as increased violence and thuggery on local construction sites.

“Let’s put it in perspective,” says Mfebe, who has been Safcec CEO since 2013. “Public infrastructure spend has been declining. In the 2017/18 financial year government’s infrastructure budget was R947.2-billion. This was reduced to R834.1-billion in 2018/19. This is a whopping 12% nominal decrease.

“Also, in 2018 there was a 15.3% decline in the nominal value of contracts awarded, with the building industry hardest hit.

“Add to the mix that all of this is happening in an industry that is historically a big investor in capital expenditure and skills development.”

Mfebe notes South Africa can ill afford to lose any more depth in its construction industry.

Already, Group Five and Basil Read, among others, have filed for business rescue.

“Once we lose that capacity, it will take years to rebuild,” says Mfebe. “We’ll increasingly see the likes of the Chinese and the French coming to Africa to build infrastructure.”

It is not only the roster of available construction companies becoming smaller.

Many highly skilled engineers and technical staff are in the process of leaving the country. Safcec has identified 110 who have already left, as they flee the low-growth environment and increasing violence on construction sites.

“This has to be attended to. The conditions contractors face are fast deteriorating,” notes Mfebe.

One of the most notable cases in recent times have been the Aveng/Strabag joint venture (JV) quitting the Mtentu bridge project, in the Eastern Cape, owing to continued violent protests within the surrounding communities...

read more

To save Eskom from ruin, SA should ditch nuclear plan and cut coal power - study

Cape Town – Eskom should cut down on its coal power network – including curtailing work at Kusile – and should not embark on any new nuclear, gas or coal building programmes if it wants to save itself from financial ruin, a new study has found.

This comes as an Eskom report seen by Fin24 and EE Publishers shows that the power utility is projecting a R3.55bn loss by the end of its current financial year. It also shows the power utility’s poor governance has left it teetering on the edge of insolvency, with only R1.2bn of liquidity reserves expected to be in hand at the end of the month.

Amidst Eskom's governance and financial crisis, President Jacob Zuma has repeatedly said that South Africa is committed to developing new nuclear power stations at a pace and scale it can afford. Critics, who believe it could cost over R1trn and that would threaten the country's fiscal framework policy, want the nuclear policy scrapped altogether.

Now, the new research report, which was published on Thursday by Meridian Economics, shows that Eskom should decommission its older coal-fired power stations and consider curtailing the Kusile construction programme in order to save costs.

These interventions can be achieved without affecting security of supply, it shows.

The study also shows that South Africa does not need a nuclear, coal or gas power procurement or construction programme. Instead, it should accelerate its transition to cleaner, cheaper, and more sustainable renewable energy when further capacity is required.

.......read more

Cape Town reprioritises budget to fund water projects

The City of Cape Town has reprioritised R2bn of its budget to fund seven additional water projects.

“We have looked at ways to fund a first phase of water supply projects by relooking at our spend across the city to see which non-water related projects we can temporarily postpone, while protecting funds for basic and emergency services,” said the executive mayor Patricia de Lille.

The first phase projects earmarked for these funds are the desalination plants at Monwabisi, Strandfontein, the V&A Waterfront and Cape Town Harbour. The Atlantis and Cape Flats Aquifer projects and the Zandvliet water recycling project make up the first seven emergency water projects of this phase.

The city made this announcement amid reports that their dam levels have dropped, with dam storage levels at 36.8% and useable water at 26.8%.

“Our dam levels have declined by 1% over the past week. This could be attributed to the high winds and hot weather, which contributed to evaporation. We have managed to halve Cape Town’s water usage with the help of 51% of our water users, who have put tremendous efforts into saving water,” said De Lille.

According to the city, water users have exceeded their water usage by 82-million litres per day, with the required level set at 500-million litres per day.

De Lille appealed to all water users, especially the 49% who are not saving water yet, to join efforts to beat the drought.

“We need to do more to bring our usage down, while at the same time pulling out all of the stops to ensure that we implement various projects for additional water supply to help see us through to winter 2018.”.......read more

State-owned companies to spend R403bn on infrastructure in the next three years

Finance Minister Malusi Gigaba estimated that over the medium-term expenditure framework, government would spend R948bn, or 5.9% of gross domestic product (GDP), on infrastructure in a bid to boost growth and employment.

This is less than the R987.4bn Gigaba’s predecessor, Pravin Gordhan, announced in the 2016 medium-term budget policy statement.

Tabling his first medium-term budget policy statement in Parliament on Wednesday, Gigaba said the majority of economic infrastructure would be provided by state-owned companies, which would spend R402.9bn in the medium term.

He said municipalities were projected to spend R197bn and provincial governments R208bn in the medium-term period.

Education was projected to spend R44bn building and refurbishing schools, libraries and laboratories.

"Government is embarking on a number of initiatives in infrastructure in order to improve the quality of our infrastructure spending. This includes maintenance of existing infrastructure, improved procurement of infrastructure projects, and better conditional grant terms to eliminate inefficiencies and underspending," Gigaba said.

He said Cabinet had approved a budget facility for infrastructure, which aimed to overcome the shortcomings in the planning and execution of large infrastructure projects.

The facility had already started considering proposals for construction in water, rail, broadband and court buildings, he said.......read more

South Africa needs to revamp its new public transport system

Over the past eight years the South African government has spent more than 130 billion rand on public transport projects in the country’s main cities. The projects included the refurbishment of rail services and the establishment of a new rapid rail and Bus Rapid Transit (BRT) systems.

This is a lot of money by any standards. As a percentage of gross geographic product, South African cities devote about twice as much money to transport as other developing countries, and as much as four times more than some regions of the world.

The country should by now be celebrating the success of this investment. But sustaining the systems, especially the BRT systems, is proving to be difficult.

Even high ranking government officials have expressed doubts about the way things are going. The MEC for transport in Gauteng province, Ismail Vadi, recently asked whether government was getting value for money from the BRT systems. His concerns have been echoed by Joe Maswanganyi, the national minister of transport.

Maswanganyi suggested that it was time to rethink and redesign the systems to “stop draining money from the fiscus”. The BRT has been called a “mammoth flop” and “a white elephant” in some media.

Those are exaggerations. But there are serious problems with the BRT.

Fixing them must focus on reducing costs and growing income. Running costs should automatically decline as the system matures. But to raise revenue levels, BRT must become better integrated with housing and other transport services so that more people use them and help pay for them. In particular, the BRT should work with minibus-taxis to help widen the net of BRT usage. The country needs better planning and funding to make this happen.

Benefits and costs of BRT

BRT systems represent a significant improvement compared to traditional metro transport systems. They use dedicated lanes and stations, modern buses, and smartcard payment systems to speed up public transport and give passengers a better quality service.

This comes at a price. BRT ticket prices are typically higher than Metrorail but are set to be competitive with the minibus-taxi offering.

South Africa’s BRT systems are currently transporting more than 120,000 passengers (one-way trips) every day. Surveys show that passengers generally prefer the comfort and speed of BRT to other modes like minibus-taxis. So, based on passenger numbers alone, BRT is not a failure.

read more

South African miners swing to R17bn profit

The South African mining industry has swung to a net profit of R17-billion this year, compared with a R46-billion loss in 2016, PwC has revealed in ninth ‘SA Mine’ report. The report, which covers 29 South African mining companies, states that spot price increases for bulk commodities supported the industry and contributed to the return to profitability. However, a decrease in dividends and market capitalisation, retrenchments across the industry and marginal increases in taxes paid showed that the industry was still facing many challenges in the year. PwC assurance partner Andries Rossouw pointed out that the industry’s revenue had increased by 13% year-on-year to R43-billion, which was the “first substantial increase in more than five years”. Operating expenses, however, increased by R13-billion, while continued low commodity prices resulted in another year with significant impairments in the industry, with a total of R22-billion in impairment provisions. More than R100-billion has been impaired over the last three years, more than wiping out the last two years of capital expenditure in the industry, the report showed. The report also outlined that the market capitalisation of the companies analysed decreased nearly to the low levels recorded in 2015.

Sanral releases draft empowerment policy it hopes will have snowball effect

The South African National Roads Agency Limited (Sanral) on Friday launched a draft transformation policy that seeks to have a “snowball effect” on the larger South African construction industry, says CEO Skhumbuzo Macozoma.

“This policy is going to trigger a review of our supply chain management policy, which, in turn, is going to change our procurement strategy. It will also change other strategies, such as human resources.

“We have identified ten areas where we want to develop subsector strategies.”

These ten areas are capital projects; road maintenance; operations; property; information and communication technology; finance and audit; legal; marketing, advertising and communication services; human capital and noncore services.

Included here, for example, is the proposal that Sanral only does business with companies that are at least 51% black-owned and with a minimum level 2 black empowerment rating, when rolling out capital projects.

Also, a maximum of 15 tenders a year will be issued to a single company, and companies will be required to make use of Sanral-approved contractors.

Concessions to manage and operate toll roads will only be awarded to companies with 51% black ownership. To reduce monopolies, Sanral will limit the number of contracts awarded to established and dominant industry players.

There will also be a focus on the “equitable allocation” of projects across Construction Industry Development Board grades, with grades 1 to 4 (emerging and/or smaller companies) to be accommodated.

Emphasis will also be placed on creating space for black business in “rigid” materials and equipment supply chains.

Sanral is also to play a more direct role in the development of emerging contractors.

In addition, communities where road contracts are implemented will have to benefit from such contracts.

“We are but one element of a very big construction industry,” said Macozoma in Johannesburg as he unveiled the transformaation policy.

“We put R20-billion into this industry on an annual basis. This is a very significant amount, but our budget in comparison to Eskom is still very small. Our budget compared with Transnet is very small. If together, under the auspices of the Presidential Infrastructure Coordinating Commission, we have a process where government galvanises its efforts, we will achieve the objective of transforming this industry together.

“We are now currently pursuing our own transformation strategies, and, of course, the sum of the pieces is not adding up to what we want. We want to locate our strategy within the strategies of the rest of government, so we can begin to swing this industry.”

Horizon 2030

Sanral on Friday also unveiled its Horizon 2030 strategy, which will guide the group’s policies for the next 13 years.

Sanral chairperson Daphne Mashile-Nkosi said Sanral had “learned some hard lessons” in the past five years, with the 2030 strategy a plan for the group “to return to grace”.

“The process will take time, patience and fortitude.”

Her comments refer partly to the combined failure of government and Sanral to convince the Gauteng public to pay electronic toll fees for a revamped road network in the country’s economic heartland.

Currently, only 30% of electronic toll revenues are collected.

The 2030 strategy considers that Sanral would like to broaden its scope to outside South Africa, with current legislation limiting it to work within the borders of the country.

Horizon 2030 also proposes a review of road transfers from the nine provinces to Sanral, limiting the planned 15 000 km to be added (to reach 35 000 km, up from the current 22 000 km) to 3 000 km.

A reduction in the kilometres transferred would result in a more sustainable national road network of 25 000 km with an increased budget per kilometre, noted Macozoma.

As for funding, Horizon 2030 notes that “uncertainties relating to adequate funding allocations from government and concerns relating to the use of private finance to develop roads, place an increasing risk on the sustainability of the high quality of the condition of the entire national road network”.

Private financing refers to tolling and toll concessions.

Macozoma sketched a picture of two scenarios in terms of Sanral future expenditure: Either private funding plays a role, with more roads to be built faster and the current network remaining in good condition, or Sanral’s budget remains reliant on the State, with roads to be built as funds become available, with new projects either delayed or cancelled. Road maintenance is also likely to suffer.

“We can take scenario one, which is growing our network to 35 000 km, with a current 5% increase in public budget allocation and a heavy uncertainty of the future of toll,” he noted.

“This is not sustainable, it’s entering very dangerous waters that will lead to the serious deterioration of the quality of our road network.

“In scenario two, where we moderate the transfer of roads from other authorities and end at 25 000 km, it means that we have sufficient infrastructure allocations to improve infrastructure. That is the scenario we are negotiating going forward.”

Public Comment

Sanral’s Horizon 2030 and its transformation policy will be open for public discussion at industry round tables between October and December.

Submission of comments closes in December.

The revision and final approval of the policies are scheduled for March next year, with implementation set for April 1, 2018.

2017 Mining Sector, Will not Disappoint

With the first two weeks of 2017 behind us, many are still reflecting on the roller coaster year that has been and the road ahead. 2016 was an extraordinary year for Kulu Group Holdings, according to the executive Chairman Mr Musa Mazubane. ''The whole economy has really had a massive surprise this year by how good of a year it has been but really the question is what happens in the future."

2017 looks to be an equally good year for us in the mining sector, thanks to industry-wide trends toward increased free cash flow, upward earnings momentum and the potential to return excess capital to shareholders. Favoured sub-sectors include diversified miners, base metal companies and selected gold companies bringing on new projects. In stark contrast, coking coal prices are plummeting right now as last year's enormous price rally is starting to unwind - albeit after an enormous gain in the second half of last year. Interestingly, Nedbank's Leon Esterhuizen and Arnold van Graan argue that Sibanye Gold's US$2.2bn purchase of Montana-based Stillwater Mining late last year is, among other things, a big bet on prices for platinum group metals and gold.

As the Executive Management of Kulu Mining gear for the 2017 Mining Indaba in Cape-town starting from the 6th - 9th February 2017, where all the top CEO’s of different mining houses converge to discuss issues and solutions that will help underpin the underperforming market. Some will meet to showcase their strength and innovative ideas to help our economy as this market is the most contributor to the South African GDP. Kulu Mining will also be there to contribute to the shaping of our countries economy by offering its innovative and cost effective solutions particularly, in the drilling and exploration techniques as this is key in mapping the direction an investor has to take after having explored the land for viable projects. Kulu Mining is going all out to increase its mining sector’s contribution to the economy in this year’s 2017 Mining Indaba in Cape Town.

“Exploring growth strategies, new projects and investment opportunities across the African continent will be the focus of both Kulu Mining and Kulu Group Holdings as a whole at the 2017 Investing in African Mining Indaba” Says the Executive Director, Mrs Gugu (Hlongwane) Mazubane

Kulu Group Holdings will be attending the 2017 Mining Indaba in Cape town on the 6-9th February 2017

Investing in African Mining Indaba is the World’s Largest Mining Investment Conference and the Largest Mining Event in Africa

Investing in African Mining Indaba is solely dedicated to the successful capitalisation and development of mining interests in Africa. Located in Cape Town, South Africa for over 20 years, this event unites investors, mining companies, governments and other stakeholders from around the world to learn and network, all toward the single goal of advancing mining on the continent. Also known as Mining Indaba, we are dedicated to supporting education, career development, sustainable development, and other important causes in Africa.

The world’s largest gathering of the most influential stakeholders in African mining –investors, mining professionals, government officials, financers, and mining service providers. Join a powerful international group of industry professionals that make Cape Town, South Africa their preferred destination to conduct important business and make the vital relationships to sustain their investment interests.

More than 6,000 delegates come from global mining and exploration companies, international investors, African and non-African governments, and a wide range of service providers including mining equipment companies, mining services providers, law firms, investment banks and financial services firms, engineering and research services, tax & accounting companies, and business/technical consultants.

WATCH THE SPACE

Zuma: New procurement law will grow black business

Cape Town – The buying power of government is a “powerful tool” to advance black economic empowerment, said President Jacob Zuma.

Speaking at a dinner honouring black business pioneers who excelled at doing business in the apartheid era, Zuma said through the public sector procurement system, government spends close to R500bn on goods and services and construction works alone.

“[This buying power of the state] can and must be used to advance black economic empowerment,” Zuma said at the event hosted at the Sandton Convention Centre.

The President reiterated that the current Preferential Procurement Policy Framework Act (PPPFA) will be repealed and replaced by new public procurement legislation that will rectify the skewed ownership and control of the South African economy.

Finance Minister Pravin Gordhan said in his medium-term budget speech on Wednesday that a new Public Procurement Bill is currently in the making and will serve before Cabinet before April next year.

Zuma reiterated that government is now determined to introduce a more flexible preferential procurement framework that is responsive to government’s objectives to grow black business.

While the new procurement legislation is going through the different government stakeholder engagement processes before being tabled in Parliament, government is working on regulations that ill improve the current PPPFA to make them more responsive to economic transformation imperatives, Zuma said.

“One of the key deliverables will be the 30% set asides for small businesses, which will be compulsory for all big contracts.”

At the dinner, attended by members of the Black Business Council (BBC), Business Unity South Africa (Busa) and National African Federated Chamber of Commerce (Nafcoc) among others, Zuma said 22 black industrialists projects have been approved since the inception of the new Black Industrialists Programme, launched by the Department of Trade and Industry earlier this year.

The approved projects are expected to yield over 1 000 direct jobs and amount to R1.2bn.

Zuma added that government would like to see the revival of the township economy. “Those corner shops that made many of our big name pioneers must be revived and supported.”

In the early 1960s and 1970s, he said, during a difficult period of repression, black business people couldn’t set up businesses in towns but were limited to black townships.

“This was when the famous township corner shops or general dealers came into being and they became an important feature of our lives,” Zuma said.

Apart from supporting small businesses, it is also important for government to support informal traders, who most of the time “fall foul” of municipal bylaws and regulations.

“We need to find a way to help them earn a living, while also respecting municipal regulations,” Zuma added.

This includes registering informal traders, as government cannot allow the “mushrooming” of businesses without knowing who the traders are, “including those from neighbouring sister countries on the continent and beyond,” Zuma said.

“This is one of the key projects of our Inter-Ministerial Committee on Migration.”

The Committee was established in April last year to deal with all the underlying causes of the tensions between communities and the foreign nationals, following xenophobic attacks on the small business owners from neighbouring countries.

Kulu Group Holdings

The Lord Propels our success.

Govt budgets R987bn for infrastructure spending

Pretoria – National Treasury has budgeted R987.4bn for infrastructure over the next three years, with investments set to be made in energy, transport and telecommunications.

This is according to Treasury’s medium-term budget, which outlined how government plans to prioritise infrastructure investment to ease bottlenecks and boost growth.

“Continued investment in energy, transport and telecommunications will boost internal and external trade efficiency. Efforts to expand co-investment with the private sector, alongside a series of other NDP (National Development Plan) reforms ... will build confidence and encourage job creation,” said Treasury in its mini budget statement.

Infrastructure projects to receive boosted investment range from a R26bn upgrade in telecommunications infrastructure to a gas-to-power programme that will procure 3 726MW.

The focus on infrastructure investment comes amid a downward revision of South Africa’s growth estimate; National Treasury has revised South Africa’s growth forecast for 2016 from 0.9% to 0.5% as part its medium-term budget statement.

And infrastructure is just one of the areas holding the country back, said Treasury.

“The main obstacles to economic activity are found within the domestic economy,” it said.

“They include infrastructure bottlenecks, low levels of competition in certain markets, a volatile labour relations environment, regulatory constraints and red tape, inefficiencies in state-owned enterprises, and uncertainties in the policy environment."

Kulu Group Holdings

The Lord Propels our success.

Kulu Group Holdings Employs Civil Engineering Students

Kulu Group Hodings has employed 12 Civil Engineering students as part of its contribution to give unemployed youth much needed work experience.

"The response we received from the advertisement was overwhelming, says Mrs Hlongwane - Mazubane, The executive Director of Kulu Group Holdings. Almost 50 Qualified Civil Engineers & came to our Head office in Durban & also in our Johannesburg office to apply. It was disheartening to see how many of our young people are sitting at home with degrees & diplomas, unable to find work and unfortunately we could only take 12 learners this year."

In a statement on Monday, 17 October, Mrs Hlongwane - Mazubane said the employment of the 12 students is a response to National Treasury's call for companies to improve work experience skills for unemployed youth.

"We need to find a way to incorporate the remaining qualified applicants and we challenge other Companies, Public and Private sectors to consider taking the graduate which we could not employ," said Mrs Hlongwane - Mazubane.

Kulu Group Holdings aims to produce qualified and experienced Engineers & Technologists over the next three years.

The provision of this on-the-job training will not only benefit students with required experience and addressing the issue of shortages of work ready skills in the country, it will also benefit them as the industry responds quicker to service disruption, improved performance efficiencies while ensuring skills transfer.

"There are not enough professional Engineers/Technologists in the country, this initiative is not just good for Kulu Group Holdings or ECSA, ultimately it will raise the competency levels of engineers in the country. We need other companies to join the cause by providing on-the-job training," said Mazubane.

The absence of professionalised Engineers & Technologists in the country is what drove Kulu Group Holdings to rectifying this shortfall. The programme is designed to challenge other Companies to follow suit and hire young minds to assist in elevating the sector through professionalization.

Kulu Group Holdings Chairman, Mr Musa Mazubane has allocated R1.2m for the programme, which will be used as remuneration for the learners during the course of three years. The programme is designed for individuals who wish to be registered as professional Engineers & Technologists and by participating in the programme learners will become recognised as professional ECSA members.

In order to qualify for professionalization, applicants must poses accredited qualifications in the Engineering field.

This Programme is not only a job opportunity for previously unemployed youth but also elevates learners existing qualifications. The successful implementation of this programme may encourage Kulu Group Holdings Chairman, Mr Mazubane to consider more students next year.

Kulu Group Holdings

The Lord Propels our success.

Kulu Group Holdings Awarded Tender to the value of R91 million

Kulu Group Holdings has been awarded a contract to construct and upgrade the Edendale main road linking the townships of Imbali, greater edendale, and Ashdown to the city of Pitermaritzburg. This is the busiest road as the traffic counts more than 800 vehicles per hour during peak hours in the morning and in the afternoon respectively.

The award has been concluded by Msunduzi Municipality and will see Kulu Group Holdings upgrading the Main Link road called “Moses Mabhida Road” for the value of R 91 million over a period of 18months commencing from April 2016.

Kulu Group Holdings

The Lord Propels our success.

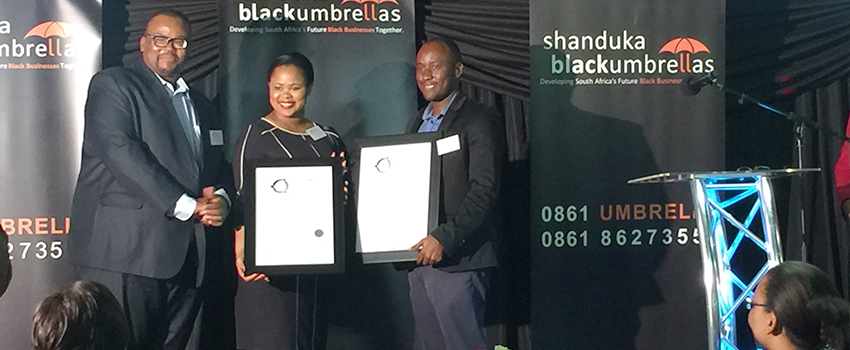

Shanduka Black Umbrelas host its Annual Enterprise Developments Awards

Kulu Group Holdings attended and won an Award of "Most Jobs Created", The directors were there to gladly receive the Award.

WHERE THE WORLD CONNECTS WITH AFRICAN MINING™

Kulu Group Holdings is therefore committed to continue bringing reliefe to the suffocating economy of South Africa, we are determined to create more job opportunities and eleviate poverty.

Kulu Group Holdings

The Lord Propels our success.

Kulu Mining had attended a successful "Mining Indada" in Cape Town February 2016

Kulu Mining had attended a successful "Mining Indada" and see some updates of the most prominent giants in mining that imparted great knowledge to even better the trade of Kulu Mining

WHERE THE WORLD CONNECTS WITH AFRICAN MINING™

Investing in African Mining Indaba® is an annual professional conference dedicated to the capitalisation and development of mining interests in Africa. It is currently the world’s largest mining investment event and Africa’s largest mining event.

UNIQUE POSITION: WHERE THE WORLD CONNECTS WITH AFRICAN MINING™

MISSION:

Investing in African Mining Indaba is an annual professional conference dedicated to the capitalisation and development of mining interests in Africa.

Investing in African Mining Indaba is the world’s largest mining investment conference and Africa’s largest mining event.

FACTS AND FIGURES OF MINING INDABA

- 20+ Years of establisment

- 7,000 + of the most internationally-diversified and influential professionals in African mining (2013 record breaking year)

- An average 100 countries & territories across six continents represented annually

- 45 African and Non-African Government delegations in participation

- 2,300 international companies represented in the delegation

- 400 (approximately) sponsoring companies representing an impressive sampling of the world’s largest mining companies by market cap

- BILLIONS OF US DOLLARS of foreign investment have been channeled into the African mining value chain throughout the last 19 years of the annual Mining Indaba. The successful collaboration amongst the organisers, the South African and many other African governments, and Mining Indaba’s partners have led to this success

- R610 MILLION in revenue has flowed directly to the local Cape economy throughout as a result of Mining Indaba (tracking from 2007-2015). This revenue includes hotels, tourism, shopping, golf and more 5,000 direct and indirect jobs have been created as a result of the Mining Indaba (tracking from 2007 through 2015) 20,000 hotel room nights sold across 40 accommodations sites in the immediate cape area 100% commitment by the organisers of Mining Indaba to partner with suppliers in South Africa who are currently or in the process of BEE certified

- Mining Indaba® is a registered trademark and is part of the legal entity of Euromoney Trading LTD.